How does venture capital funding workin cryptocurrency? | |

|

More people are using cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). However, newcomers may find the complexity of the crypto world intimidating. A cryptocurrency is comparable to other forms of money. The distinction is that cryptocurrency is decentralised and digital. It is "decentralized" if a central authority or government does not support it and is instead directly run by the users of the underlying technology.

The technology behind cryptocurrencies is called blockchain. Blockchain is a decentralized platform that keeps track of all network transactions. When someone gives Bitcoin to another person, a transaction record is stored in the public blockchain and is independently confirmed by many users.

Cryptocurrency transactions are kept secure, legitimate, and transparent because of this dual record-keeping. The identity of the people who participate in the transactions is kept confidential despite each transaction being recorded. In other words, anyone can view the amount of Bitcoin sent, but they cannot view the parties involved in the transaction.

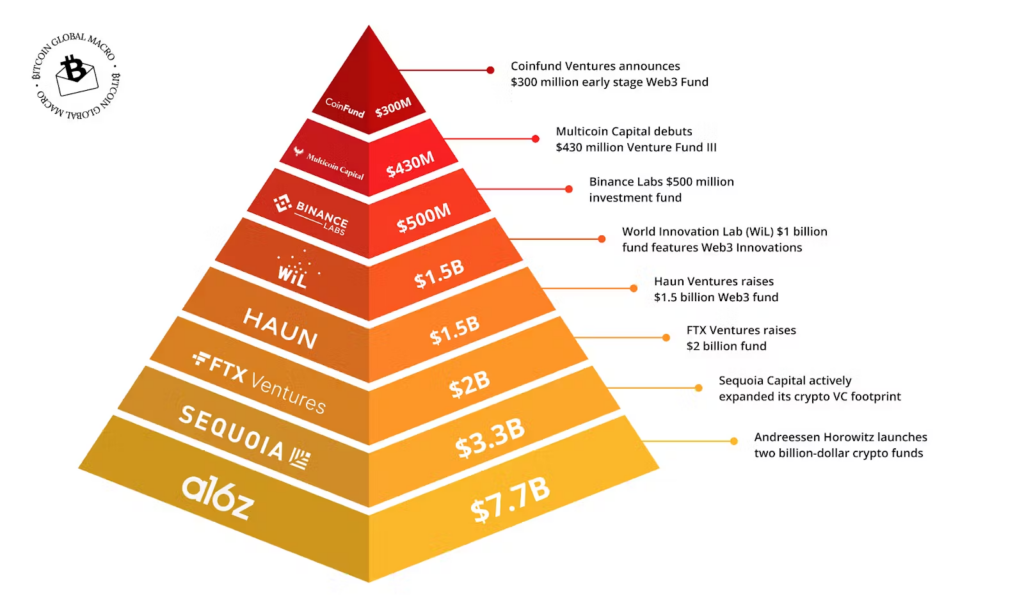

Cryptocurrencies are unquestionably a significant part of the future, as seen by their rising popularity and the massive amounts of effort and money invested in the sector. To promote entrepreneurs, venture capitalists have recently begun pouring money into the cryptocurrency market.

Venture capital investing of Crypto VC firms has been more popular recently. As a result, crypto finance typically aims to help long-term projects that need ongoing assistance and funding.The term "venture capital" describes the money that venture capitalists lend to early-stage firms, typically in return for equity shares.

When it comes to Cryptocurrency Market Analysis, venture capital might be utilized to jumpstart the initiative, hire staff, or get ready for an initial coin offering (ICO). Thus, depending on the start-up’s needs at the time, venture capital can play different roles in the development and growth of a start-up.

When it comes to the crypto/blockchain industry, how does venture capital funding work? Understanding how bitcoin financing operates is critical to understand why cryptocurrency firms are looking for VC capital. A firm needs a thorough business plan with a roadmap outlining the milestones and dates before an investor will consider investing in it. Venture capitalists will therefore study, analyze, and appraise the viability of the crypto project to determine whether a cryptocurrency firm can deliver on its claims.

The same standards and best practices that have historically been used in venture capital investments guide the appraisal process for cryptocurrency and blockchain projects. However, the use of blockchain and tokenization as a means of raising money for the start-up is what distinguishes crypto from other industries. The predicted user population, the team behind the company, the future worth of the cryptocurrency coin, and other factors are crucial for crypto venture capitalists.

Vc firms in the crypto industry: how do they work? The method of investing in cryptocurrency start-ups by crypto venture capital firms is very similar to that of traditional venture capital fundraising. However, this industry has become lucrative for investors due to the adoption of blockchain technology and the rise in the price of cryptocurrencies. Despite the market's turbulence, blockchain technology and Crypto VC Funding have gained popularity and media attention. Although it can be a high-risk investment option, decisions must be carefully considered and based on information. | |

|